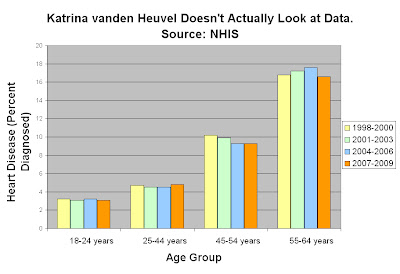

Nurses’ prescription for healing our economy

By Katrina vanden Heuvel, Tuesday, October 4, 11:55 AM

If you want to know just how bad things are for those hit

hardest by the Great Recession, ask a nurse: They see more young men suffering

heart attacks,

more anxiety in children,

Often mistaken for pushier

Ritalin sales reps.

and more ulcers and stomach illnesses in people of all ages.

I’m too lazy to do

any more research. This woman is trying way too hard to tie finance to health.

Financial struggles are forcing more patients to forgo

necessary medicines and treatments.

[citation needed]

A Princeton/Georgia State study reports a 39 percent

increase in ER admissions for suicide attempts precipitated by home

foreclosures, and a direct correlation between foreclosure rates and increases

in emergency-room visits and hospitalization for hypertension, diabetes and anxiety.

It’s cute to see

someone pointing to statistics and confusing causation with correlation. Plus,

there’s no indication of how strong the correlation is. How about an R-squared

value, lady? The reason that there are more suicides “precipitated” by home

foreclosures is that there are more home foreclosures.

Given this widespread hardship and pain, it makes sense that

nurses who are on the frontlines in our communities

Technically, military

hospitals are precisely the opposite of front lines.

every day are leading an effort to hold Wall Street

accountable for causing these economic troubles while raising hundreds of

billions of dollars for vital human needs.

And there’s the jump

from incompetent to crazy. No, Katrina. It doesn’t make sense at all that

nurses would try to rage against Wall Street.

National Nurses United (NNU), the nation’s largest union and

professional association of nurses, representing 170,000 RNs, is out in the

streets, in congressional offices and just last week in Liberty Park

Is this sentence

still going?

with the Occupy

Wall Street

What a bunch of

world-beaters those guys are.

pushing a good idea that has been around for decades and

whose time has come:

Is this sentence still going?

a financial-transactions tax.

Oh Jesus. Obviously

KVH believes that “it makes sense” that nurses have an expertise in tax policy

and financial markets. I forgot that they took courses in derivative valuation

and Macroeconomic Theory in between Pharmacology and Physiology.

This is a small levy

Tax.

on trades of stocks, derivatives and currencies meant to

curb short-term speculation while raising massive revenue

Wait, I thought it

was teensy weensy “levy.” How can something so small raise “massive revenue?”

Here’s what will

actually happen with this idiotic (and massive) tax: First, volume will shrink

on the major exchanges, and plummet on the minor exchanges as investors who

would otherwise like to buy American stocks will begin looking to more a more

favorable regulatory environment overseas. Whatever countries avoid this new plague

of financial lunacy will see a new influx of investment that will propel new

growth.

As the cost to

reallocating away from perilous ventures increases, what remains of domestic

investors will trend away from speculation and flee to safety. Indexing will

become the norm. This permanent shift towards safety and stability will suck up

the capital ordinarily allocated to the start-ups and growth industries that

propel job creation.

The decrease in trading

volume coupled with widespread indexing strategies will have the dual effect of

showing government revenue estimates to be wildly inflated and undermining

market efficiency. Frequent trading curtails the forces suppressing arbitrage

opportunities. As a result, there will be more likelihood of arbitrage for

large institutional investors that will be inaccessible to smaller investors

because of scale.

The increase in

transaction costs will drive up the required rate of return for debt and equity

securities. Companies will then see their cost of capital increase, and as a

result, will pursue fewer new projects. It may cause some to favor debt

financing, which is more stable than equity, thereby shifting the capital

budget towards higher leverage ratios and increasing default risk.

Finally, “financial

transactions” is an inherently murky designation. This will eventually creep

into a national sales tax or a VAT tax, as all “transactions” are, by the very

nature of being transactions, financial. In addition to this being economic

poison, it’s also inherently unconstitutional.

for urgent needs.

Because without the

ever-present gluttony of the leviathan, firefighters’ children will go hungry

and blah blah blah.

Since June, thousands of nurses have protested on Wall

Street, at the U.S. Chamber of Commerce in Washington ,

and the Federal Reserve Bank in San

Francisco

Clearly they don’t

have much going on in their personal lives.

“In my practice as a staff nurse in a downtown Boston

Because what’s a more

reliable way to measure a major nationwide trend than the anecdotal evidence of

a single nurse in Boston

“A nurses’ union must do so much more than just negotiate

fair pay and decent working conditions.

It must also

cultivate delusions of grandeur within its management.

It must use its power to promote the overall well being of

its members and the public they care for.”

No. Promoting the

well-being of its members and the public at large are two different and

contradictory items. Nurses unions don’t promote the well-being of the public;

that’s what hospitals are for. Nurses unions bargain against hospitals. Nurses unions

use their power to oppose the overall well being of the public.

Last month, at NNU’s convention in San Francisco

Wait, Michael Moore

was there? And not one of these nurses had the decency to recommend Lap-Band

surgery?

“It’s so necessary,” said Moore

Technically, it would

have been the nurses union that was onto something, but if Moore

There is indeed a sense that this idea needs to become a

reality.

This may be the worse

sentence I’ve read in the last month. I’ve missed it. I might have to check out

some My Immortal.

This is no marginal idea: The “Tobin Tax” to discourage

short-term currency speculation was originally suggested by Nobel laureate

economist James Tobin in 1972. Just last week, Bill Gates endorsed a small tax

on financial transactions as a way to raise substantial resources for

development spending.

And yet, no one can

explain how a small tax raises “substantial resources.”

In Europe , centrists and

even some conservatives now embrace such an idea.

Does anyone really

think that we should be following the European financial model in the midst of

Greek default and the pending dissolution of the European currency? Anyone?

German Chancellor Angela Merkel and French President Nicolas

Sarkozy have both signaled their support, and the new head of the International

Monetary Fund, Christine Lagarde, was a strong proponent of a

financial-transaction tax as finance minister of France

And they all have one

thing in common: no one over here gives a damn what they think.

Last week, the European Commission released proposed

legislation for an EU-wide financial-transactions tax.

So if this is all

about Europe ’s new and exciting way to slide

towards socialism, why the hell did we have to do all that crap with the

nurses?

Also last week, German Finance Minister Wolfgang Schaeuble,

a conservative, made his strongest statement yet on the matter. “Before the end

of the autumn we are going to create a tax on financial transactions. If

necessary, I’m sure, just in the eurozone,” said Schaeuble.

Cool. It’ll be

interesting to see what happens when the equity markets suddenly shrivel across

Europe as savings pour into the East Asian

markets.

But in the United

States

Holy crap, she

misspelled Obama. Hilarity ensued.

economic team have torpedoed this idea. According to Ron

Suskind’s new book, “Confidence Men,” President Obama supported the tax before

then-chief economic adviser Larry Summers nixed it.

Of course he did.

Obama supports just about any tax you can levy.

It comes as no surprise that Treasury Secretary Tim

Geithner, who Suskind reports was referred to as “our man in Washington

No one likes poor

Timmy.

He recently attended a meeting of eurozone finance

ministers, urging them to get a grip on their debt crisis,then

Another typo. This

just feels shoddy. (The article, I mean, but I suppose one could say the same

about Geithner’s economic joust with Angela Merkel.)

immediately said that the United States

Somehow, I don’t

trust Geithner enough to think he actually said that. I allocated all of my

research time on the graph, though, so I’m not going to look it up.

Geithner drew a strong rebuke from Austrian Finance Minister

Maria Fekter, a conservative.

Transatlantic

conservatism is kind of like football. Sure, there are 11 guys on the field,

but when you show up in Germany

“I would have expected that, if he explains the world to us,

that he would also listen to what we want to explain to the Americans,” she

said.

That’s not really

much of a rebuke.

“The Europeans are way ahead of us on this, with the real

possibility of implementing financial transactions taxes in the next year,”

Somehow, I’m okay

with falling behind to Europe in this shit

sandwich of an idea.

said Sarah Anderson, director of the Global Economy Project

of the Institute for Policy Studies, who zealously follows this issue. “The

nurses union is doing a tremendous job of pushing the United States

And yet, no one can

explain what the fuck any of this has to do with nursing.

It’s no surprise that the corporate-owned mainstream media isn’t

paying much attention

She writes, without a

trace of irony, published in the Washington

to the activism around this issue by NNU and organizations

such as the National Peoples Action, Jobs with Justice, the American Dream

Movement and Americans for Financial Reform.

To be fair to the “corporate-owned

mainstream media,” those guys tend to do a pretty good job marginalizing

themselves.

Thousands of nurses insisting that they be heard on an issue

that would help their patients

HOW?!? HOW WOULD A TAX

INCREASE ON FINANCIAL TRANSACTIONS HELP PATIENTS IN ANY CONCEIVABLE WAY? I

NORMALLY DON’T LIKE TYPING IN ALL CAPS BUT MY INCREDULOUS BEFUDDLEMENT DEMANDS

MORE THAN A SIMPLE SNARKY COMMENT. WHAT THE HELL IS SHE TALKING ABOUT. I FEEL…I

FEEL LIKE…

seems to be of little interest to most in the national

press, while three tea partyers

Is this the proper

pluralization? The tea party has been part of the popular vernacular for two

and a half years, and people still haven’t figured out a generally accepted

pluralization for individuals sympathizing with the tea party movement. Odd.

on a corner are treated as a major media event.

Wah wah wah.

But a financial-transactions tax now has support at the

highest levels of economic power

I think you’re

overestimating Bill Gates.

and out on the streets,

I think you’re

overestimating the Nurse’s Union .

where tens of thousands of nurses and their allies are

helping to lead the fight to heal Main

Street

Why on earth is she

so excited about this new revenue source? It’s not like government spending is constrained

by revenues. Indeed, federal expenditures are mostly fixed, whereas tax

receipts and revenues can fluctuate 2-3 percentage points from the mean based

on the business cycle.

There is simply no

reason for anyone to get this excited

about a new avenue of taxation unless she is championing the use of the

government to assault those with whom she disagrees. It’s no surprise; it’s

what socialists do.

from those who created the economic debacle,

This meme can’t be

repeated enough times to make it true. Government caused the financial

meltdown.

and to restore Wall Street and global finance to its proper

role of serving the real economy.

No comments:

Post a Comment